gst increase 2022

The rise was announced on November 18 by the Central Board of Indirect Taxes and Customs CBIC. It was actually implemented in order to enable Singapore to lower its corporate and income tax rates effectively shifting the burden of generating tax revenue to the poor.

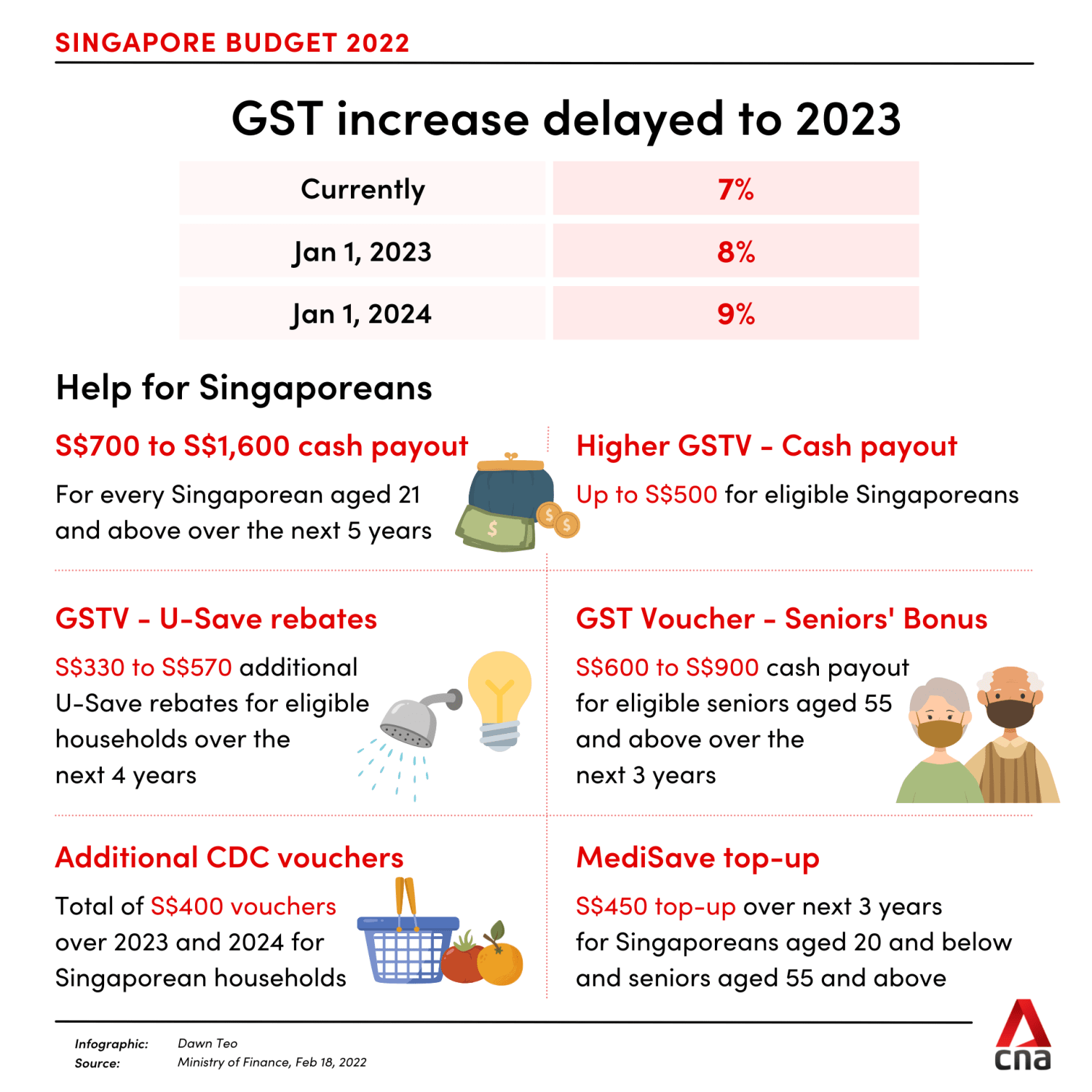

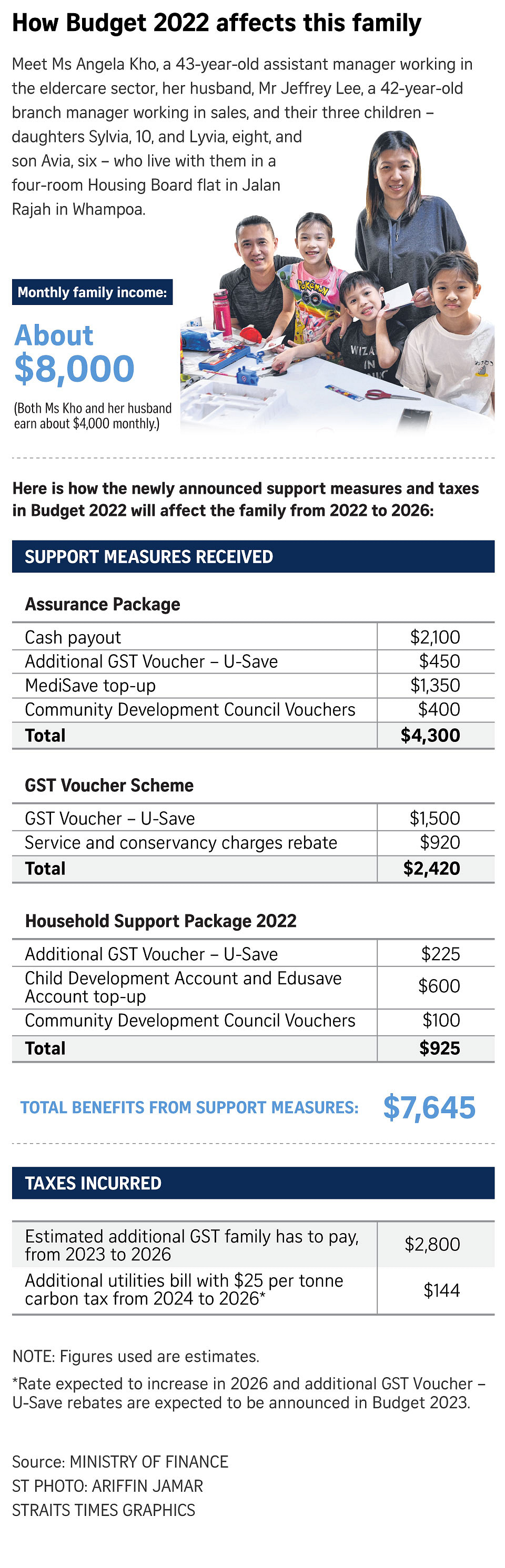

SINGAPORE The Goods and Services Tax GST will be increased progressively rising to 8 per cent with effect from Jan 1 2023 and going up again to 9 per cent in 2024 Finance Minister Lawrence Wong announced on Friday Feb 18.

. PM Lee Ministry of Communications and Information Prime Minister Lee Hsien Loong. GSTHST credit like many other government credits and benefits is indexed against inflation. GST hike to be delayed with increase tiered at 8 in 2023 and 9 in 2024.

Sporeans aged 21 and above to get S700 to S1600 cash payout over next 5 years. The tax rate applicable to transfers above the exemption is currently 40. The increase will be.

The government has raised the GST ie goods and services tax on finished goods such as clothes footwear and textiles from 5 to 12 beginning January 1 2022. This will become effective January 1 2022. 23 hours agoUnveiling the 2022 budget in parliament Wong said the goods and services tax GST hike would take place in two steps with an increase from the current 7 per cent to 8 per cent next January.

GST Voucher 2022 payout date GST is a regressive tax which means it disproportionately affects the poor who spend a higher fraction of their income on goods and services. The current GSTHST payment period started in July 2021 and ends by June 2022. 19 hours agoSince the previous Budget in 2021 the Government has announced its intention to increase the GST rate from the current 7 to 9 within the period of 2022 to 2024.

23 hours agoSINGAPORE Singapores goods and services tax GST will be raised from next year and it will be staggered out in two steps. Textile sector rate changes services applicable from 01012022 Notification No. Budget 2022 will therefore lay the basis for sound and sustainable government finances for the next stage of Singapores development The plan to raise the GST by two percentage points from 7 per.

Teletherapys crucial role in reaching remote students. He assured Singaporeans that the Government. 1 day agoGST Hike from 7 to 9 will be announced in the Singapore Budget 2022 on the 18 February 2022 Now that were supposed to have gotten used to Covid life the government has decided that its time.

From 7 to 8 per cent on 1 January 2023 and from 8 to 9 per cent on 1. Singapore to raise GST from 7 to 9 in two stages in 2023 and 2024 Goh Yan Han Political Correspondent SINGAPORE - The goods and services tax GST rate will increase from 7 to 9 per. On the recommendations of the GST Council the Central Board of Indirect Taxes and Customs CBIC announced that the GST rate on garments textiles and footwear would be raised from 5 to 12 with effect from January 1 2022.

23 hours agoBudget 2022. However there wont be an increase to the GST amounts outside of the normal annual inflation indexation. GST increase to be staggered over 2 years starting from Jan 2023.

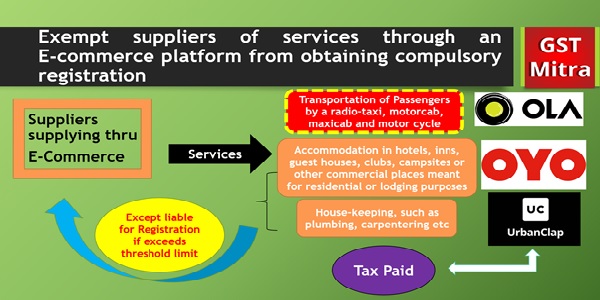

Also transport services provided by e-commerce operators like Ola and Uber will also be charged 5 GST while services provided by auto-rickshaw drivers through offline manual mode would continue to be exempted. Used or new rags scrap twine cordage rope and cables and worn out articles of twine cordage rope or cables of textile materials not exceeding Rs. This is expected to add about S18 billion in revenue in 2022 and S36 billion annually or close to.

Govt has to start moving on GST increase in Budget 2022 as economy emerges from Covid-19. The Government will delay the planned Goods and Services Tax GST hike to 2023 and stagger the increase in two steps Finance Minister Lawrence Wong said in his Budget speech on Friday. As such the Government may introduce a two per cent increase in GST as early as July 2022.

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. 23 hours agoThe increase in Goods and Services Tax GST will be delayed till 2023 said Minister for Finance Lawrence Wong in Parliament as part of the 2022 Budget statement Feb. At the time of writing GST is currently 7 but the government plans to raise it to 9.

The Government has to. From January 2022 the GST rate on fabrics will be raised to 12 percent from 5 percent and the GST rate on garments of any value has been raised to 12 percent compared to the previous rate of 5. GST increase to be staggered over 2 years starting from Jan 2023.

When was the last GST. The date of the hike will be known during the Budget announcement on 18 Feb 2022. SINGAPORE The Goods and Services Tax GST will be increased progressively rising to 8 per cent with effect.

Analysts TODAY file photo Plans to raise the GST from 7 to 9 per cent between 2021 and 2025 were. No good time to raise GST but 2022 provides window of opportunity politically and economically. Morley Companies Incorporated Data Breach Grit Daily News.

During this years Budget 2022 we collectively heaved a sigh of relief as it is announced that the GST increase will only take effect from 1 January 2023 instead of this year as. A SIGNIFICANTLY higher percentage of small and medium-sized enterprises SMEs in the community and personal and professional services industries are hoping for a delay in the implementation of the Goods and Services Tax GST increase according to UOBs SME Outlook Study 2022. GST Increase 2022.

Pin By Karan Krishna On Efiling In 2022 Filing System Indirect Tax Goods And Service Tax

Akhil Amit And Associates Is A Young Fast Growing Chartered Accountancy Firm Ca Firm With Its Head Office In 2022 Investment Advisor Chartered Accountant Finance

Gst New Era In 2022 Important Changes Effective 1st Jan 2022

Trademark In 2022 Trademark Registration Business Start Up

New Gst Changes Applicable From 1st January 2022 Ask Masters

Asuja Eserv Private Limited It Consulting Company Works With Clients To Help Them Solve It Problems Consulting Companies Solving Development

Bad News For Fashion Goods And Service Tax Goods And Services Bad News

Comments

Post a Comment